What Is Margin Trading?

绿油油的小草

Updated at: a year ago

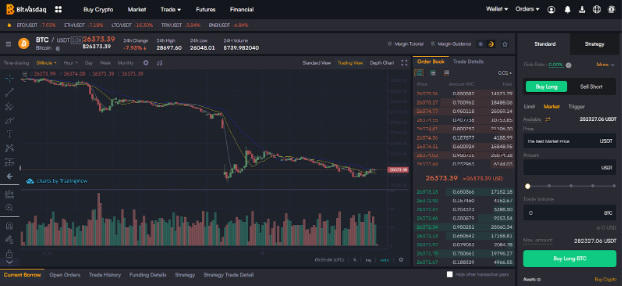

Margin Trading in crypto involves taking a loan from the exchange to complete the trading process. Margin trading in the cryptocurrency market involves borrowing funds from an exchange to conduct trades. It is commonly known as trading with leverage because traders increase their trading capacity beyond their available capital.

For example, if you want to conduct a trade for a bigger benefit, where you want to buy a certain amount of BNQs, but your available capital is not enough. In that case, you can borrow a certain value from the exchange you’re conducting the deal on. The exchange in this case gives its traders leverage as well, which can help the profits increase by 5x or 10x or 15x or so and so forth. The trader will earn more than they anticipated earlier. In such an instance, it also benefits the exchange as well where the trader has to return the loan with some interest.

How Does Margin Trading in Crypto Function?

Margin Trading in crypto entails borrowing money to execute larger or more frequent trades. One crucial aspect to consider is the liquidation price. When the market reaches this price, the exchange automatically closes the position to protect traders from losing the borrowed funds. When trading solely with their capital, the liquidation price for a long position on an asset is zero. However, as leverage increases, the liquidation price moves closer to the entry price of the trade. Margin lending enables investors to establish both long and short positions, allowing them to profit regardless of market direction.

Example of Margin Trading

Let's take an example where the price of one BNQ Token is $5,000. A trader decides to engage in BNQ Margin Trading and enters a long position with 2x leverage, investing $5,000 and borrowing an additional $5,000. Therefore, the total position value before fees and interest would be $10,000. In this scenario, the liquidation price would be slightly above $2,500. Once this level is reached, the trader would lose their entire investment, including interest and fees.

The reason for this lies in the leverage. Ordinarily, a drop in price to zero would be necessary for a trader to lose their entire position when investing $5,000. However, with 2x leverage, the bet is doubled, magnifying potential gains or losses by two times the initial investment. Consequently, if the price drops by 50%, the trader would lose 100% of their investment (50 x 2 = 100).

Calculation of Liquidation Price

To calculate the market movement that triggers liquidation, divide 100 by the leverage level. For instance, a position with 10x leverage would require a 10% movement to trigger liquidation (100 / 10 = 10). In the volatile crypto market, a 10% move can occur within hours or even minutes. It's important to note that trading with leverage is risky in any market, and the higher the leverage used, the greater the risk. Margin trading in the crypto market carries additional risk due to its extreme volatility.

What Are the Fees Associated with Crypto Margin Trading?

Now the question arises what is the benefit for the exchange when they give their traders loans to fulfil the trade? Margin trading in crypto incurs two types of costs:

-

The opening position fees

The opening position fees are the fees that are required to secure and book a slot for yourself when trading. In Margin Trading when you are bidding for crypto and you secure a position for yourself, you will attain a certain amount of crypto for certain charges. Securing that position costs opening position fees.

-

Interest charges for borrowing cryptocurrencies

The interest rate, also known as the "funding rate" is peer-to-peer and depends on various factors such as the current premium between the spot and futures price of an asset. This rate is typically recalculated on an hourly basis.

Benefits and Disadvantages of Margin Trading

Margin Trading in crypto has its benefits, this type of trading is best for gaining bigger profits in a small amount of time. This sort of trade allows traders to make larger bids even with a small amount of capital. It allows the trader to leverage on making a winning bid and allows the traders to keep lesser assets in the exchange. But, with everything good there also comes a side with disadvantages. The disadvantage of such a trade is the 50/50 chance of liquidation. If the trader loses the bid, they can face a 50% chance of profit loss.